The Terabank card account is a multi-currency account which must be opened in the following four currencies: USD, EUR, GEL or GBP.

If the currency of the transaction amount matches any currency of the account (USD, EUR, GEL, GBP), the amount will be debited from the account in the corresponding currency. If there is an insufficient amount in the account, the amount of the transaction is converted from the account that has more money in the balance to fill the mentioned account.

When the currency of the transaction amount does not match any account currency (USD, EUR, GEL, GBP), the amount will be deducted from the USD account. If there is not enough money in the USD account, the transaction amount is converted from the account with more money to fill it.

The bank serving the ATM abroad often adds a withdrawal fee to transactions made with Terabank cards. Its amount is not known to Terabank but a warning about the presence of a fee appears on the ATM screen in advance and so the transaction is completed only after confirmation by the user.

Cards

Frequently asked questions

A bank serving a POS terminal or an ATM abroad, instead of paying or cashing out in that country's currency, often offers the customer an alternative option in the form of Dynamic Currency Conversion (DCC). The DCC service operates in more than 66 currencies and is the income of the bank serving the POS terminal or ATM.

- At the moment of payment with international Mastercard and Visa cards or cashing out at an ATM, the foreign merchant offers the client the opportunity to perform the transaction in GEL or another country's currency;

- During the process of the payment or cash out using the DCC service, the merchant/POS-terminal or the ATM service bank is obliged to transparently inform how much the user will pay or cash out during the payment (purchase) or cash out in GEL or other currency by displaying this information on the screen of the ATM or the POS-terminal. Accordingly, the user chooses the currency and then confirms the desired option;

- After confirmation and execution of the DCC service, the customer's cheque shows the conversion rate, the relevant currency and the amount that will be debited. This helps the user to choose the currency with which to pay or cash out with the card and at the same time monitor the balance of the card in the relevant currency;

- The transaction is converted at the time of purchase or withdrawal by the POS terminal/ATM serving bank before the transaction is authorized. The conversion rate is set by the bank servicing the POS terminal or the ATM as it represents its income. In case of DCC, Terabank does not earn any income.

- The user has the option of choosing a currency and transparently sees the converted amount before confirming the transaction;

- The user knows and selects the currency exchange rate before the transaction;

- As a result of the service, the user receives an easy-to-understand cheque and card statement. The service also has the ability to show the card’s balance.

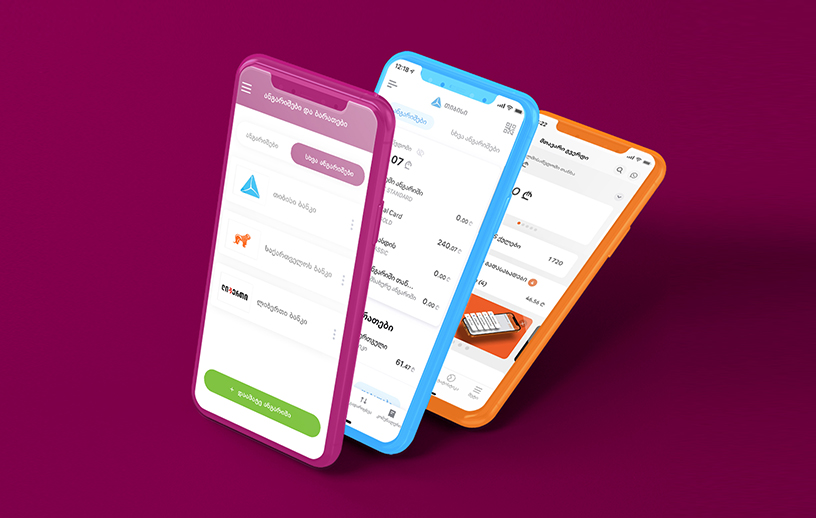

Services

Change Phone Number Remotely

Change your registered phone number in Terabank from the comfort of your home.

Referral Program

Become our customer, refer your friend and get Tera Points as a present.

Escrow Service

Take advantage of Escrow Services and protect yourself from unnecessary risks.

SMS Signature

SMS code instead of signature – save time and take care of the environment.